Was just reading that actually. As with all these things confusion reigns! I’m continuing as if it’s happening, I can’t afford to have clients not able to process on thr 15th if the delay is less than we’ll thought out!

Just found this

https://eba.europa.eu/-/eba-publishes-an-opinion-on-the-elements-of-strong-customer-authentication-under-psd2

Reading it seems to me that some banks were not ready In time which had a knock on effect on software merchant providers and it these that can apply for extension but it does state EBA can not change EU law so that adds to confusion.

For me it is a simple tick box on Cartloom changing PayPal Pro to PayPal.

Just been chatting with the dev of the scripts I use, they are based in the EU (not UK), they have been speaking to their other clients in the EU who are saying as far as they are the regs will be kicking in with them on 14th.

Just how a Global banking and customer buying base is going to actually work with SCA being applied in some rather than others is beyond everyone I’ve spoken to so far!

Advice is be ready for the 14th, regardless, cus unless you are 100% sure your customers and their banks are in the UK some might still need to conform.

Clusterfuck.

@steveb I have phoned FCA and been on phone for nearly 40 minute. They do not have a clue! So the poor girl there has emailed Jonathan Davidson, Executive Director for Supervision – Retail and Authorisations who did press release for clarification.

I agree with you - get it done by 14/09 and then you know where you stand! I will come back with FCA response if I ever receive one - most probably after 14th! :-) lol

I was a licenced credit broker for about 15 years, so I’m very familiar with the FCA and it’s competencies! After the banking crisis the old version of the FCA was deemed unfit for purpose, so was reinvented and rebranded. Much the same people involved but after reinvention, they added daylight robbery to their list of achievements, along with what amounted to fraud.

Back in about 2003, I paid a special one-off fee for a “licence for life”, this meant no more having to re-apply and pay every year. As part of the reinvention, they cancelled them all and made us all reapply, along with unbelievably and complex to assess application fees. Seriously, it was madness. You had to take the amount of credit you arranged and divided it by the total fees charges, then if this was over a certain figure you multiplied it by X, if under by Z, then you added another number, and divided that by the number of transactions, from which you subtracted the day of the week, plus the wind speed at the time of signing, and if that figure had two zeros in it you doubled it. Or summit like that.

No one knew how to really work it out. Brokers doing similar levels of business were sent widely different bills. I challenged their right to remove my life-time licence, which cost me a packet, but it got nowhere. then, in the end, the cancelled the whole thing and went back to a simple, but high, yearly fee.

It was a mess.

I cancelled my licence in 2016 but they still tried to claim each year from me, because I hadn’t cancelled it in the right way: To cancel it I had to create an account on one system, then request it and the broker licence get cancelled. But by now the broker licence had ran out, and I needed an active one to create the account I need to cancel it! This trundled on til March this year when with three years fees being demanded my solicitor put in a claim to them for mental anguish, caused by the constant threat of court action… We never heard from them again.

So they’ve gone from being a useless bunch of bastards to a corrupt useless bunch of bastards.

I’ve gone off topic a bit there!

wow. A catch 22

Guys just had two emails from FCA see below - interesting! :-) Name removed to protect the innocent! :-)

Dear Paul

14 September stands as the date of when these rules are implemented. However, specifically for the eCommerce industry (Online shopping) they have been given an additional 18 months if they wish to implement these changes sooner then that is their commercial decision.

Yours sincerely,

Supervisor / Supervision Hub Supervision Retail and Authorisations

Email above is answer to a question for further clarification

Financial Conduct Authority

You’ve mentioned in your email in the FCA press statement dated 13/08, it states SCA and extension by 18 months and in the link to EBA which states an opinion that it can not change the law of EU and 14/9 is go ahead date. You’ve mentioned the information is confusing and contradictory.

I have taken a look into the link to the EBA website and it explains that due to the complexity of the payments markets across the EU and the challenges arising from the change that are required. On a exceptional basis and in order to avoid unintended negative consequences for some payment service users after 14 September 2019 to provide limited additional time. This is to allow issuers to migrate to authentication approaches that are compliant with SCA, such as those described in the publication, and acquirers to migrate their merchants to solutions that support SCA.

Therefore, the FCA have implemented changes to work with firms to implement this in a way that protects consumers while minimising disruption. We also want to ensure that authentication methods are available for all groups of consumers.

"For online banking, the changes will be phased in from 14 September 2019 and completed by 14 March 2020.

For online shopping, we have agreed a plan with the e-commerce industry of card issuers, payments firms and online retailers that gives them 18 months up to March 2021 to implement SCA. This reflects the position agreed with the European Banking Authority and other EU regulators that, given the complexity of SCA requirements, the lack of industry preparedness, and the potential of significant disruption for consumers, industry needed more time.

At the end of the 18-month period, we expect all firms to have made the necessary changes and testing to apply SCA. Consumers may

notice changes to the way they authenticate their identity when shopping online during this time."

The date of the 14 September still stands however we have given firms additional time to implement these changes. As this is a EU regulation, if you want to know as a eCommerce retailer how these regulations would impact your business you may wish to seek independent legal advice and/or speak to your payment service provider.

I hope my response has been helpful. Yours sincerely,

Supervisor / Supervision Hub Supervision Retail and Authorisations

Financial Conduct Authority

As suspected, SCA is only delayed for UK issued cards and UK banks, if you process cards issued outside the UK or any bank in the chain is outside the UK you still need to comply by 14th Sept 2019.

This makes delay is rather pointless for many.

Good news indeed!

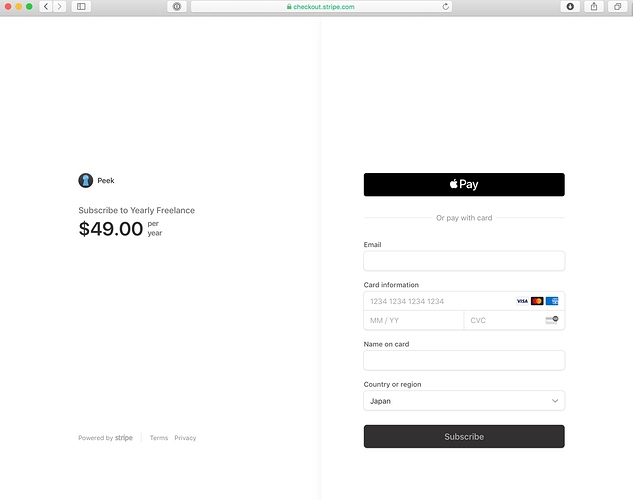

@yuzoolthemes On the ‘Real live working site in RW8’, none of the card/apple pay links work - only the Paypal ones. trust this is a minor glitch?

Update - works fine now.

Hi all,

I’ve just purchased Yuzools Checkout 2 stack only to discover that it no longer includes Custom amounts…only Fixed or Subscription amount settings.

The stack has lost one of its main features!!!

Beware before purchasing if you rely upon Custom Amounts.

Scott